Why your board needs Demand Spaces

We recently completed a multimarket piece of Demand Spaces work for a global healthcare organisation, which covered every category and product line in their business. This project was unusual in that the board engaged with the consumer-centric map of the market we delivered. The Chairman, CEO and CMO have used the work to plan where to invest to secure growth over the coming ten years.

Demand Spaces have tremendous value for these types of decisions but, in our experience, the results don’t always make it this far up the company. At best, our clients in insights and marketing teams use demand spaces to support ideation and decision making in areas such as communications, innovation and customer experience. At worst, the work can get left on the shelf in the insights department after the debrief. The most successful projects are those as described, where demand space work is used to support the big decisions taken at board level such as growth strategies, capital investments, mergers and acquisitions.

We have been thinking about how to get every Demand Spaces segmentation into the boardroom and use our years of experience in this type of research and consultancy to maximise our client’s investment and enable C-suite stakeholders to unlock Future Consumer Value.

Why don’t boards use Demand Spaces?

We think there are two main reasons. One is that the C-suite just isn’t aware of the great tools that the marketing and insight team have. Often, marketers don’t have the access to the right conversations and the level of influence and credibility required to get that seat at the table. The other is that demand space work is typically not designed with this end in mind and is lacking the information that board members need, such as clear financial projections and rigorous assessments of viability.

Much of our work around demand spaces more recently has been in addressing these two issues by helping marketers speak the language of the C-Suite and by taking our demand spaces to the next level with additional statistical analysis and forecasting.

So, how do you make Demand Spaces board-ready?

C-suite stakeholders need to make clear informed commercial decisions about where to invest. For this, it’s not enough to show them where the opportunities lie. They also need those opportunities to be sized in terms of potential volume, market share and return on investment. And what can often be forgotten, is that they need to see the same for the flip side – the risk of not investing in those spaces.

Opportunities

What constitutes an opportunity, as far as board members are concerned? They need to know that the space is large and/or fast growing and that it could be profitable, and they need this quantified. More than that, they also need a qualitative understanding of whether their brands fit in the space and whether moving into that space is feasible from a practical perspective. Finally, they need to know the consumer point of view – is there a level of dissatisfaction or an unmet need to satisfy and do consumers have money to spend in this space?

Risks

The flip side is the risk of not moving. Board members need to know how well competitors fit in this space and whether they are in a position to get there first or copy and improve upon what we do. They also need to understand are we in a space that is shrinking, where we are a poor fit, competing with bigger brands or where we have too many brands tightly concentrated so we are cannibalising our own products?

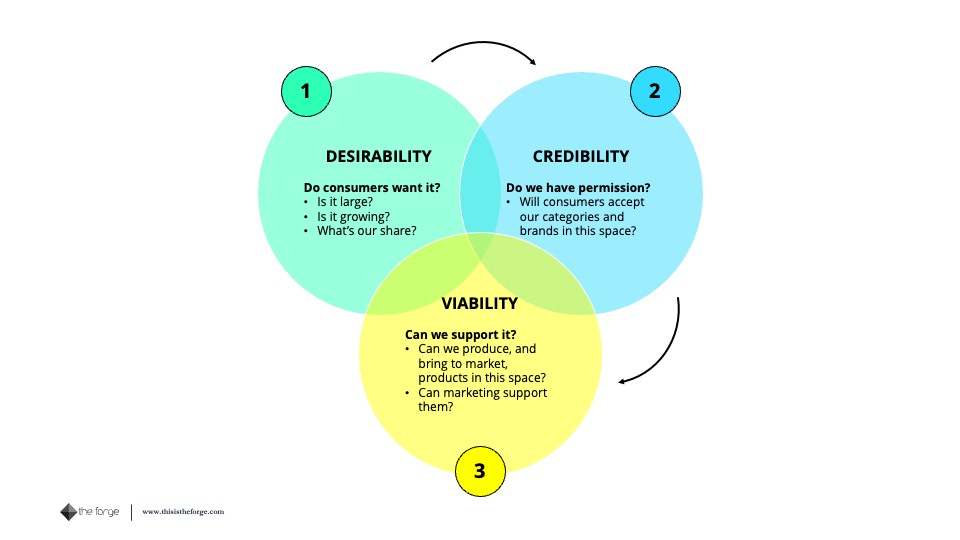

The DCV framework: desirable, credible and viable

To answer these questions rigorously and comprehensively, we use a framework which we call DCV. This is consulting layer that goes beyond the survey data set to identify and size opportunities and risks. The DCV framework assesses whether a space is desirable, credible and viable.

Desirable

- What: sizing the demand space in both value and volume terms and then forecasting growth.

- How: this begins as a predominantly data-led activity but requires judgement and experience when overlaying and quantifying external factors.

- Inputs: client and 3rd party value and volume sizing data, consumer momentum, category CAGRs, trends and other external drivers such as macroeconomics or climate.

Credible

- What: identifying where our brands have the right to play from the consumers’ point of view.

- How: predominantly led by advanced analytics techniques however this element requires judgement to bring together and calibrate the different inputs.

- Inputs: brand perceptions, Demand Space needs and product features. We’ve developed an approach to fit and footprint analysis which quantifies the relative extent to which a brand or category aligns with the needs or features of a Demand Space.

Viable:

- What: the extent to which we think the company can deliver against a demand space given the internal constraints under which it operates.

- How: this is internally focussed and leans on consulting skills. We’ve developed a thorough and rigorous approach here to understand what’s achievable given the realities of the constraints, how many brands marketing can support and whether there are restrictions around production or supply chain.

- Inputs: stakeholder interviews with innovation, supply chain and operations teams

Upside and risk

Using the framework and bringing these factors together alongside consumer satisfaction and willingness to pay, we can quantify the realistic financial headroom within each Demand Space. Where we’ve identified a desirable space where the organisations’ brands fit well with consumer needs and it can feasibly be supported, then we can quantify the potential share gain available should the organisation be willing to back it. Similarly, if we identify that a certain brand fits well with a space, and has the potential to grow by x%, we can also say that the risk is that without support it may lose y% share to well-placed competitors.

In summary

Demand spaces are valuable tools for board-level decision-making about the big questions that businesses face. When combined with consultancy and additional analysis to size the risks and opportunities, they become essential tools for the board and can be the key to unlocking Future Consumer Value – so don’t leave yours on the shelf.