Over recent months at The Forge, we’ve been talking and writing about how brands can rebuild post-pandemic, mostly through a sustained focus on fewer, bigger, better opportunities. One key tool for achieving this focus is Demand Spaces.

We’re big fans of Demand Spaces, but they are often misunderstood and misapplied, frequently confused with needstates, occasions or even shopper missions. This is a shame because used correctly they can be incredibly effective tools. In this post, we’ll discuss what they are, whether there is still a role for them, and how we might use them in the future.

But first, a quick history…

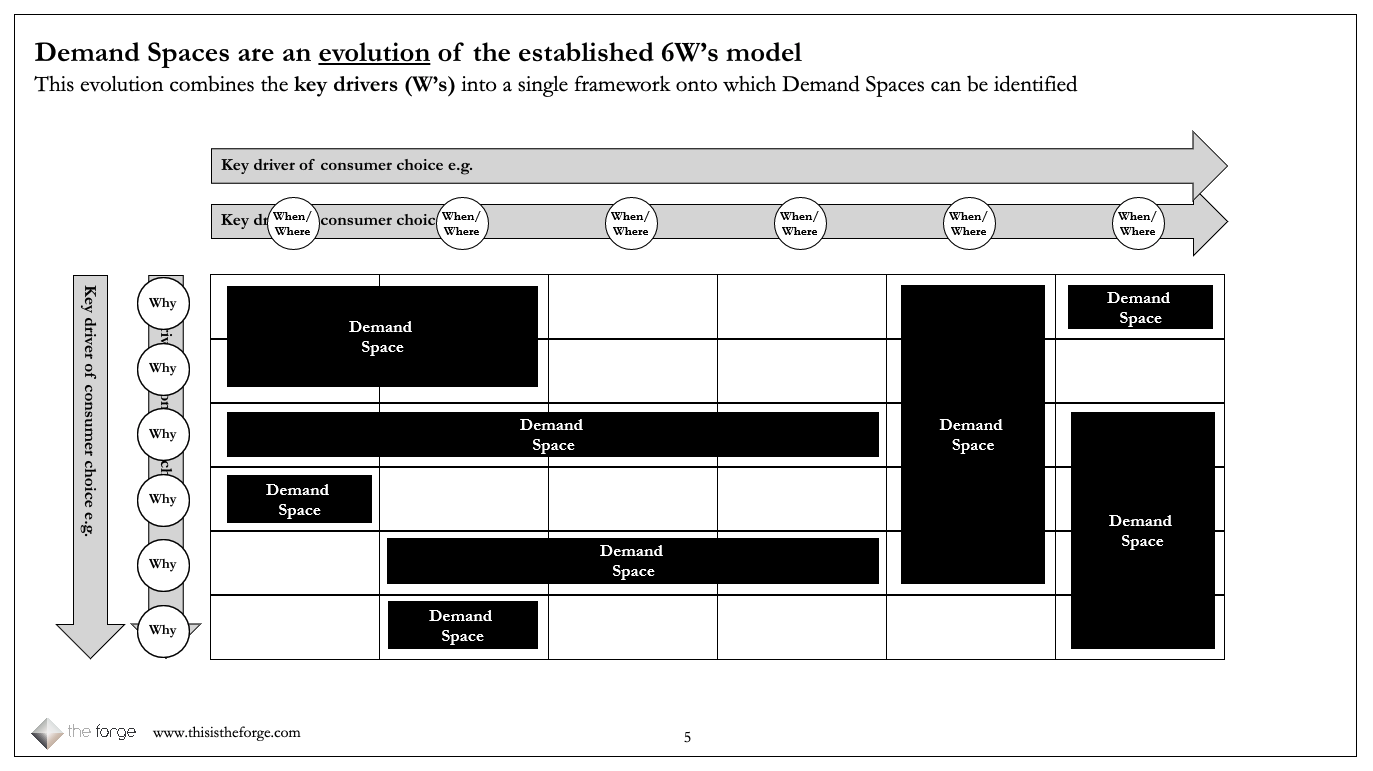

In the mid-2010s, a new way of segmenting consumers and customers started to gain traction (we even wrote an article describing them as ‘the shiny new toy everyone was talking about’). At that time, pioneering consumer goods companies including PepsiCo realised that by combining more than one ‘W’ from the traditional 6Ws model (e.g., WHO is consuming your product and WHEN/WHERE are they consuming it?), they were able to identify pockets of demand that were previously overlooked, thus resulting in sharper propositions and communications. As a result, Demand Spaces continued to grow in popularity and increasingly became the default tool for anyone looking to segment their market.

Proceed with caution

That brings us to the current issue. In spite of their ubiquity, it’s easy to overlook the fact that Demand Spaces are just one of the many market segmentation tools at the disposal of the marketeer. And as with all tools, they are only effective when used for the right job. We always advocate that before you reach for the toolbox, you start by accurately defining the business question you are seeking to answer. Once you’re clear on that, you’ll then be able to tell whether Demand Spaces are the right tool to deploy for your situation.

So how do I know when to use Demand Spaces?

Demand Spaces are ideal when more than one dimension is driving consumer behaviour and the business is willing to segment on whichever combination of ‘Ws’ truly predict choice. For example, in a category like snacking, where the context or occasion is important, the combination of WHERE/WHEN (e.g. weekday lunch, weekend BBQ etc.) and WHY (e.g., filling, indulgence, slimming etc.) creates much richer spaces than that given by a single W alone (e.g. vs. a purely WHO-based attitudinal segmentation). Whereas by contrast, categories like fashion and automotive i.e., those that are more linked to a consumer’s sense of their own personal identity, tend to benefit from a more singular WHO-based focus – in these categories simply introducing an additional dimension won’t usually increase understanding.

Creating effective Demand Spaces

Once you have decided Demand Spaces are the right approach for your situation, and you’ve identified the drivers that best predict choice, you’ll need to ensure that your spaces are appropriately defined. Zoom too far out and each space will be too broad, losing the multi-dimensional benefits of nuance and richness. Zoom too far in, and it’s likely you will finish up over segmenting. This can happen when too greater reliance is placed on one of the Ws to pull the market apart. In these instances (often in an attempt to build richness back in), the Demand Spaces finish up becoming increasingly granular. Yes, they may hold up statistically, but a model with 15-20 Demand Spaces does not finish up as a useful simplification. You end up with tiny opportunity areas (mid-morning-mum’s-me-time anyone?) that become too difficult to meaningfully address.

Focusing too narrowly reduces potency

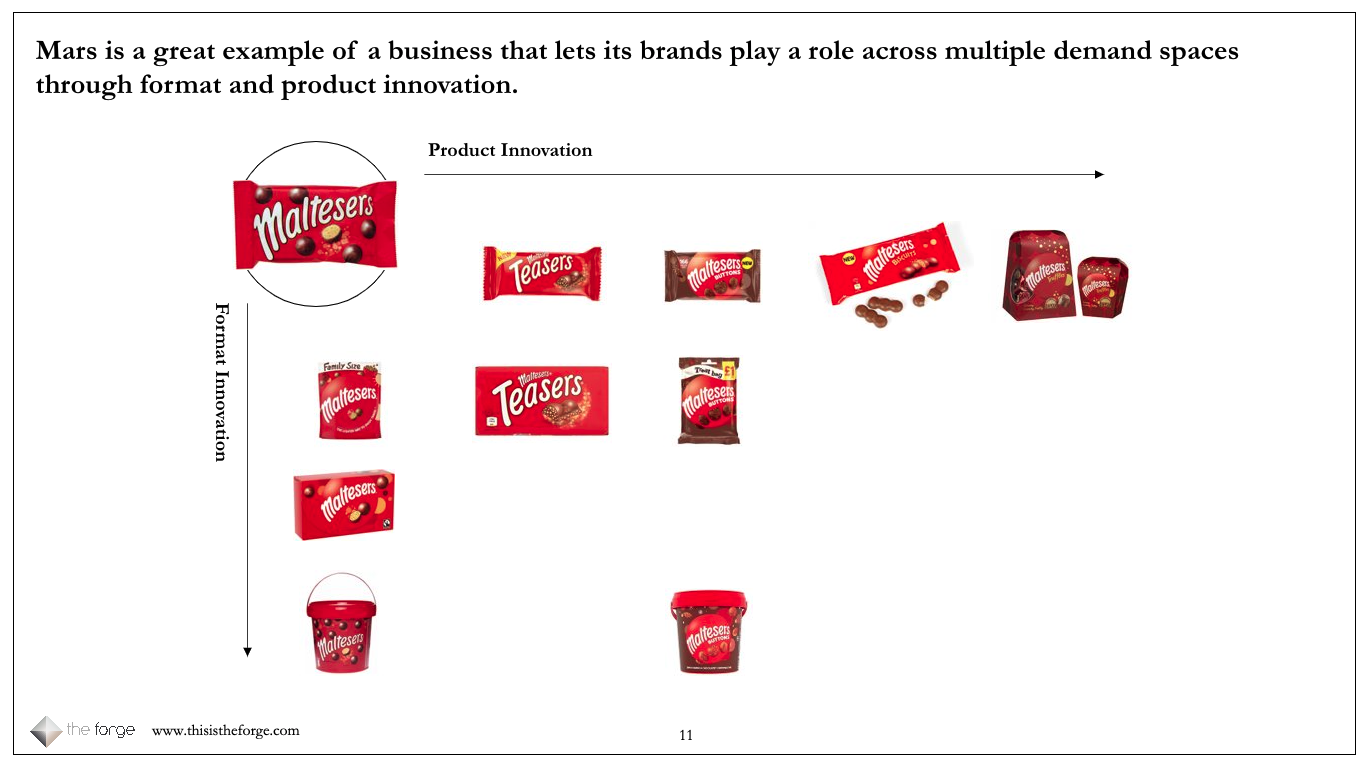

We’ve also seen instances of brands assigned a single piece of the Demand Space landscape, forcing them to innovate and communicate in an overly restrictive space. If the objective is increasing frequency, then focusing on a single Demand Space can help. But if the objective is penetration, that is often best achieved by combining Demand Spaces to engage more users and expand the brand footprint – Mars is known for successfully deploying its brands across multiple Demand Spaces via format and product innovation.

In our view, Demand Spaces can help marketers identify and focus on fewer, bigger, better opportunities to unlock growth. But we must get comfortable using them as flexible frameworks, led first by our commercial ambitions.

Demand more

Finally, we should be more demanding of our Demand Spaces. As with all tools, they work best within a toolkit, when we are able to link them into our other frameworks and models. Connecting them to owned and third-party data to improve decision making or overlaying them onto a customer journey to more precisely influence awareness, consideration and trial. When they are chosen purposefully, executed accurately and utilised effectively, Demand Spaces can still be an incredibly powerful tool to help you access fewer, bigger, better opportunities for your brand.

For more information about how we work at The Forge, find out more in our whitepaper: How To Create A Winning Customer Strategy